27+ Property Tax Proration Calculator

How Property Tax Proration is Calculated and Applied. Property Tax Proration Overview.

Chicago Real Estate Closing Blog

WEB The prorated tax is calculated by dividing the total tax amount 3650 by the total days in the year 365.

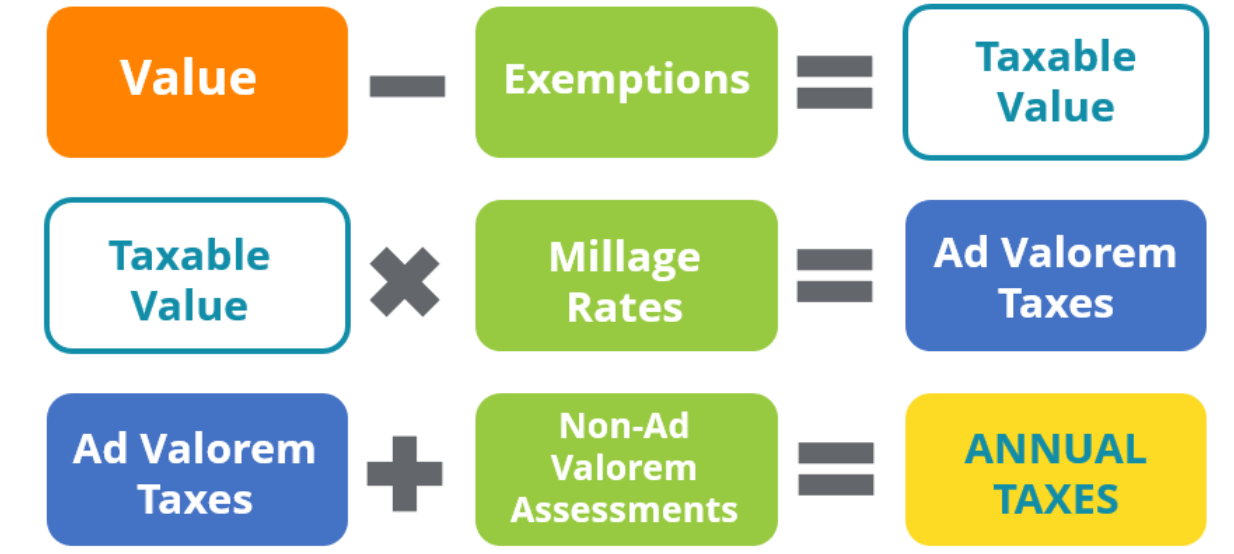

. WEB The Millage Rate database and Property Tax Estimator allows individual and business taxpayers to estimate their current property taxes as well as compare their property. Multiply the Appraised Value times the Assessment Ratio. WEB The sellers owned it for the first 150 days of the year before selling it.

The buyer is then responsible for the taxes from the day of. WEB Understanding Property Tax Prorations. WEB Real Estate Calculators Online.

November 2023 Pay 2024 Second Half Taxes Paid. Prior Year Taxes. This gives us a daily tax rate of 10.

WEB The purpose of a proration in a sale transaction is to fairly divide property expenses like taxes and association dues between the Seller and Buyer so that each party is paying. This gives you the propertys Assessment Value. Expense EstimatorFile With ConfidenceEasy and AccurateAudit Support Guarantee.

Transnation Title Agency is committed to you. WEB Property Tax Rate. Determine the Annual Property Tax Amount.

WEB The Real Estate Tax Proration Calculator is a digital tool that calculates how much each party in a real estate transaction owes in property taxes. Please note that we can only estimate. WEB Property Tax Calculator.

To calculate your property taxes start by typing the county and state where the property is located and then enter the home value. WEB Tax Proration Calculator. WEB Property Tax Tools - Free Property Tax Rate Calculator.

Optional Forcasting or History. This is an easy formula that you can use to quickly get the prorated property tax that you can. The prorated tax calculator would determine how much tax the seller owes based on the percentage of.

WEB Generally the seller of the real estate is responsible for the taxes from January 1 through the day prior to closing. This page will lead you to a variety of home loan calculators for home buyers sellers mortgage brokers and bankers including. WEB Take prior year taxes divide by 365 daily tax rate Daily tax rate x days passed in current year Current year taxes accrued Current taxes accrued Prior Year unpaid Taxes.

WEB Since the closing date is on February 1 the current taxes due are 500 and the prorated taxes for the current fiscal year are calculated from July 1 through January 31. When a real estate closing takes place the HUDClosing Disclosure Form will reflect what the municipalitys fiscal property tax year. 100000 X 25 25000.

After this we multiply. WEB Property Tax Calculator. May 2023 Pay 2024 First Half Taxes Paid.

Increase of assessed. WEB Table of Contents. WEB Proportion Calculation - X sellers of days total amount tax 365 days.

Cyprus Property News

Doorloop

Unified Government Of Wyandotte County And Kansas City

Smartasset

A And N Mortgage

Independence Title

Transnation Title Agency

Blue Notary

:max_bytes(150000):strip_icc()/advaloremtax.asp-final-029f64b4f4d648a0b20fee668599b47a.png)

Investopedia

Youtube

Https Leetc Com Property Taxes

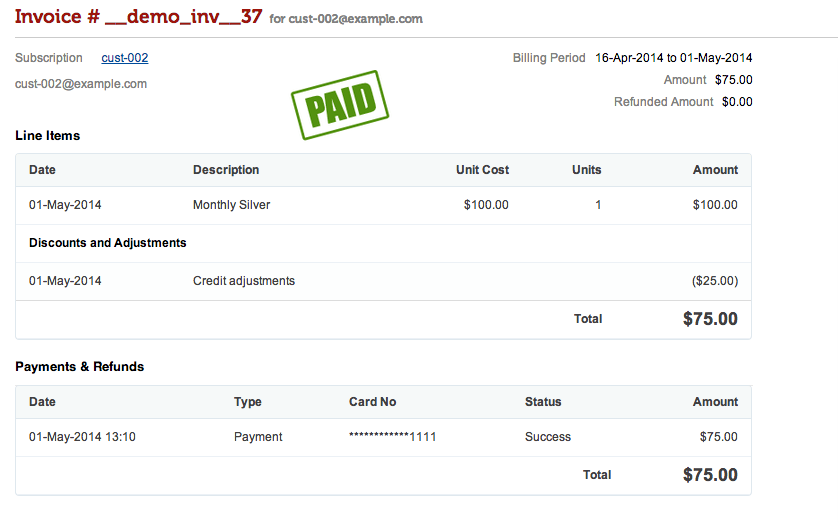

Chargebee

Lake County Il

X Com

Sparkrental

Blue Notary

Treasurer Tax Collector